Think back to your science class in school. Remember learning about fossil fuels? Well, natural gas is one of them. It’s a hydrocarbon gas mixture found deep underground, formed from the remains of ancient plants and animals. Over millions of years, pressure and heat transformed these organic materials into the natural gas we use today.

Now, natural gas isn’t just one thing. There are different types, but the most common is methane. It’s odorless and colorless, but utility companies add a distinctive smell to it so you can detect leaks easily. Other gases found alongside methane include ethane, propane, and butane, each with its own unique properties and uses.

Current Trends in Natural Gas Exploration

Let’s talk about what’s happening right now in the world of natural gas exploration. Thanks to advancements in technology, we’re able to find and extract natural gas from places we couldn’t reach before. Take hydraulic fracturing, for example. Also known as fracking, it involves injecting a mixture of water, sand, and chemicals into rock formations to release trapped gas. This technique has opened up vast reserves of natural gas in places like the United States, transforming the energy landscape.

And it’s not just the US getting in on the action. Countries like Russia, Qatar, and Iran are major players in natural gas production, with massive reserves waiting to be tapped. In fact, according to the International Energy Agency (IEA), global natural gas production reached over 4 trillion cubic meters in 2020, with demand expected to keep growing in the coming years.

Investment Opportunities in Exploration Projects

Now, let’s talk business. Investing in natural gas exploration projects can be a lucrative opportunity for those willing to take the plunge. Imagine putting your money into a project that strikes gold, or rather, strikes gas. Companies involved in exploration are constantly on the lookout for new reserves, and if they hit the jackpot, investors can reap substantial rewards.

But it’s not all sunshine and rainbows. Investing in exploration projects comes with risks. Geological uncertainties, regulatory hurdles, and fluctuations in gas prices can all impact the success of a project. That’s why it’s essential for investors to do their homework and assess the potential risks before diving in.

Extraction Methods and Technologies

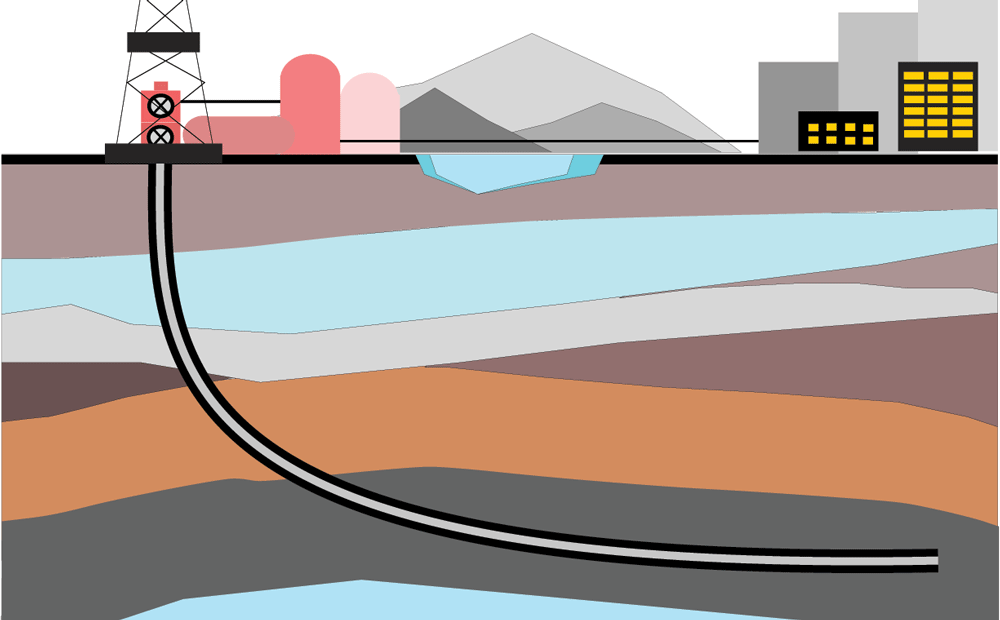

Alright, let’s get down to the nitty-gritty of extracting natural gas from the ground. There are several methods, but one of the most common is hydraulic fracturing, or fracking. This technique involves drilling deep into the earth and injecting a mixture of water, sand, and chemicals at high pressure to fracture rock formations and release trapped gas.

But fracking isn’t the only game in town. There’s also horizontal drilling, where wells are drilled horizontally through rock formations to access gas reserves. This method allows for greater access to gas deposits and can increase overall production.

Market Dynamics and Demand Outlook

Now, let’s talk about the demand side of the equation. Natural gas is a versatile fuel used for heating, electricity generation, and industrial processes. With growing populations and increasing urbanization, the demand for natural gas is expected to continue rising.

But it’s not just about the here and now. Natural gas also plays a crucial role in the transition to cleaner energy sources. As countries look to reduce their carbon emissions, natural gas is seen as a cleaner alternative to coal and oil. This shift towards cleaner energy sources is driving demand for natural gas and creating new opportunities for investment in the sector.

Regulatory Environment and Risks

Of course, no discussion about investing in natural gas would be complete without mentioning the regulatory environment. Governments around the world have regulations in place to ensure safe and responsible extraction of natural gas. From environmental regulations to safety standards, companies operating in the natural gas sector must comply with a host of rules and regulations.

But regulatory compliance isn’t the only risk investors need to consider. There’s also the risk of price volatility. Like any commodity, the price of natural gas can fluctuate due to factors like supply and demand, geopolitical tensions, and economic conditions. These fluctuations can impact the profitability of natural gas projects and affect investor returns.

Case Studies and Success Stories

Now, let’s take a look at some real-world examples of successful natural gas projects. One notable success story is the Marcellus Shale in the United States. Discovered in the early 2000s, the Marcellus Shale is one of the largest natural gas fields in the world, covering parts of Pennsylvania, West Virginia, and Ohio. Thanks to advancements in fracking technology, the Marcellus Shale has transformed the US energy landscape, making the country a major player in natural gas production.

Another success story comes from Australia, where the Gorgon Project has become one of the world’s largest natural gas projects. Located off the coast of Western Australia, the Gorgon Project involves extracting natural gas from deep beneath the ocean floor and processing it into liquefied natural gas (LNG) for export to markets around the world. With billions of dollars in investment and decades of planning and development, the Gorgon Project is a testament to the potential of natural gas as a global energy source.

Investment Strategies and Tips

So, you’re ready to dip your toes into the world of natural gas investment. But where do you start? Well, here are a few tips to get you going. First, do your research. Understand the fundamentals of natural gas, from how it’s formed to how it’s extracted and used. Second, diversify your portfolio. Investing in natural gas can be risky, so spread your investments across different projects and companies to mitigate risk. And finally, stay informed. Keep up-to-date with industry news, market trends, and regulatory changes to make informed investment decisions.

Conclusion

In conclusion, natural gas exploration and extraction offer exciting opportunities for investors looking to capitalize on the world’s growing energy needs. From advancements in technology to changing market dynamics, the natural gas sector is ripe with potential for those willing to take the plunge. So, whether you’re a seasoned investor or just dipping your toes into the world of investing, consider adding natural gas to your portfolio. Who knows? You might just strike gold, or rather, strike gas.